In our ongoing blog series exploring key insights from our recent Fintech candidate survey, we're diving deeper into the factors driving career decisions in today’s market. In the first post, we explored the shift from funding stages to industry verticals as a primary focus for candidates. Now, we're turning our attention to compensation packages and the growing importance of non-monetary benefits.

Changing Priorities in Compensation: The Rise of Equity and Annual Leave

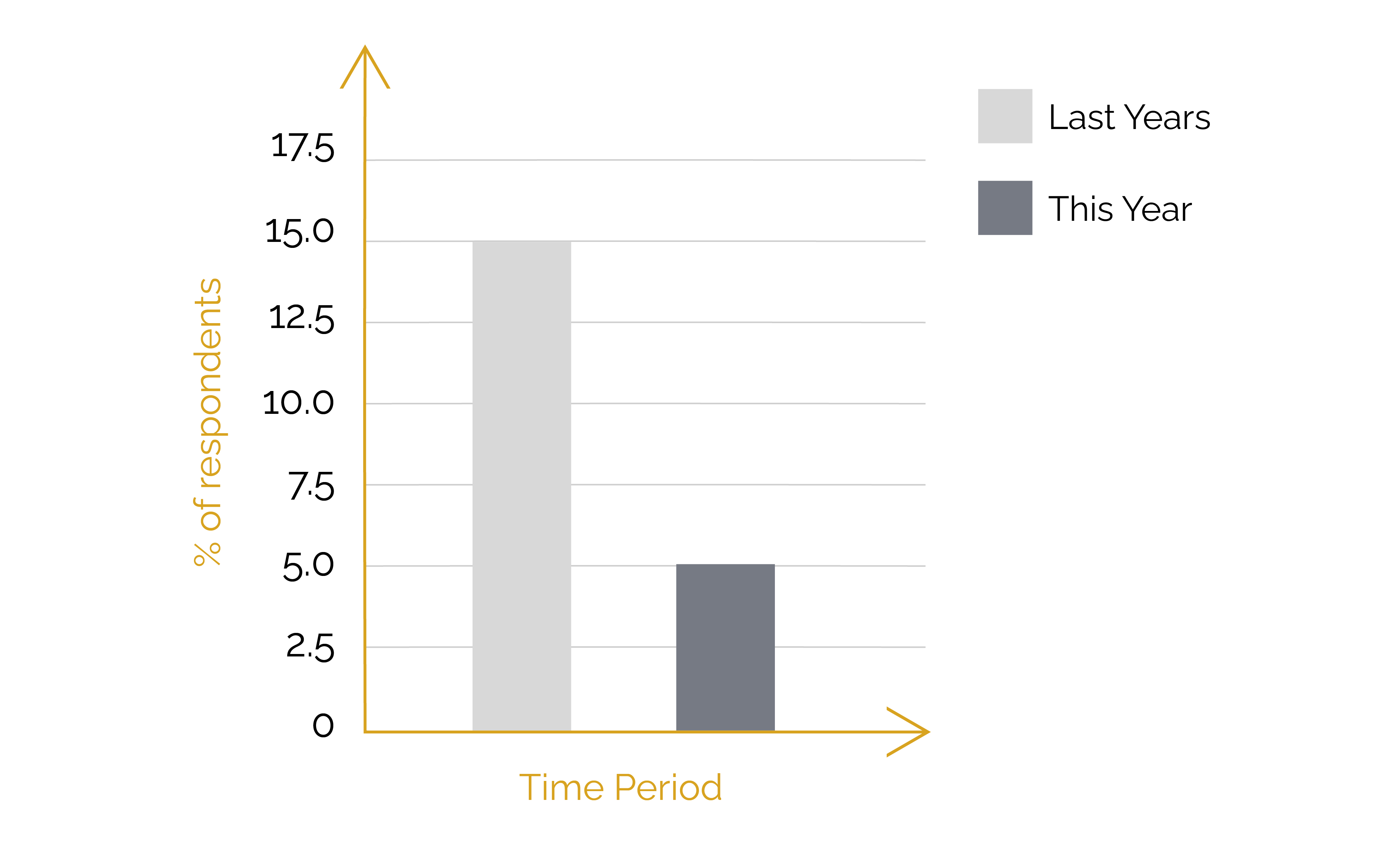

Our latest survey data highlights a surprising trend: the bonus, once a highly valued component of compensation packages, has dropped sharply in importance. Just a year ago, 15% of respondents listed bonuses as a top priority; now, that figure has fallen to only 5%. In its place, candidates are looking for stability and a sense of long-term value in their compensation packages.

Equity and Annual Leave: The New Compensation Leaders

This shift isn’t just about moving away from bonuses, it’s also about embracing benefits that provide enduring value. For the first time, over half (52%) of our respondents chose annual leave as their most desired benefit, surpassing other traditional perks. Candidates seem to be focusing on work-life balance and seeing time off as essential to their well-being and productivity.

Equity is also gaining traction. As Fintechs navigate a challenging market environment, offering equity can be an effective way to align employees with long-term company goals. For candidates, equity represents not only a financial asset but a stake in the company’s future, signalling trust and commitment to sustainable growth.

Non-Monetary Benefits in an Evolving Workforce

This trend underscores the growing importance of non-monetary benefits in today’s workforce. In an environment where professionals increasingly value holistic, sustainable work experiences, employers are finding that benefits like flexible leave policies and equity are key to attracting and retaining top talent.

The evolving workforce also suggests that candidates are prioritising stability over short-term financial incentives. Amidst a backdrop of economic uncertainty, non-monetary perks that contribute to long-term security and well-being are resonating more than one-off bonuses.

The Importance of Long-Term Stability in Fintech

As the report reveals, Fintech companies are increasingly moving away from a “growth at all costs” mindset toward a focus on sustainable, profitable growth. This industry shift is impacting candidates’ priorities, too. Rather than being drawn to immediate financial rewards, professionals are gravitating toward compensation packages that offer long-term stability. Equity and annual leave, with their potential for lasting value, have become favoured over bonuses and short-term gains.

This change highlights an important trend: candidates are looking for employers with a commitment to stability and growth. As Fintech companies focus on profitability and resilience, they’re more likely to attract talent who are in it for the long haul and value companies with clear, long-term strategies.

Conclusion: Rethinking Compensation to Attract Top Talent

For Fintech companies looking to attract and retain the best talent, offering competitive leave policies and equity packages may be more critical than ever. As candidates increasingly value stability and long-term growth, compensation packages that focus on these aspects are likely to resonate more deeply.

Stay tuned for the next post in our series, where we'll continue to explore these shifts in candidate preferences and what they mean for the future of Fintech recruitment.

Alternatively, you can catch up on Part 1 here.