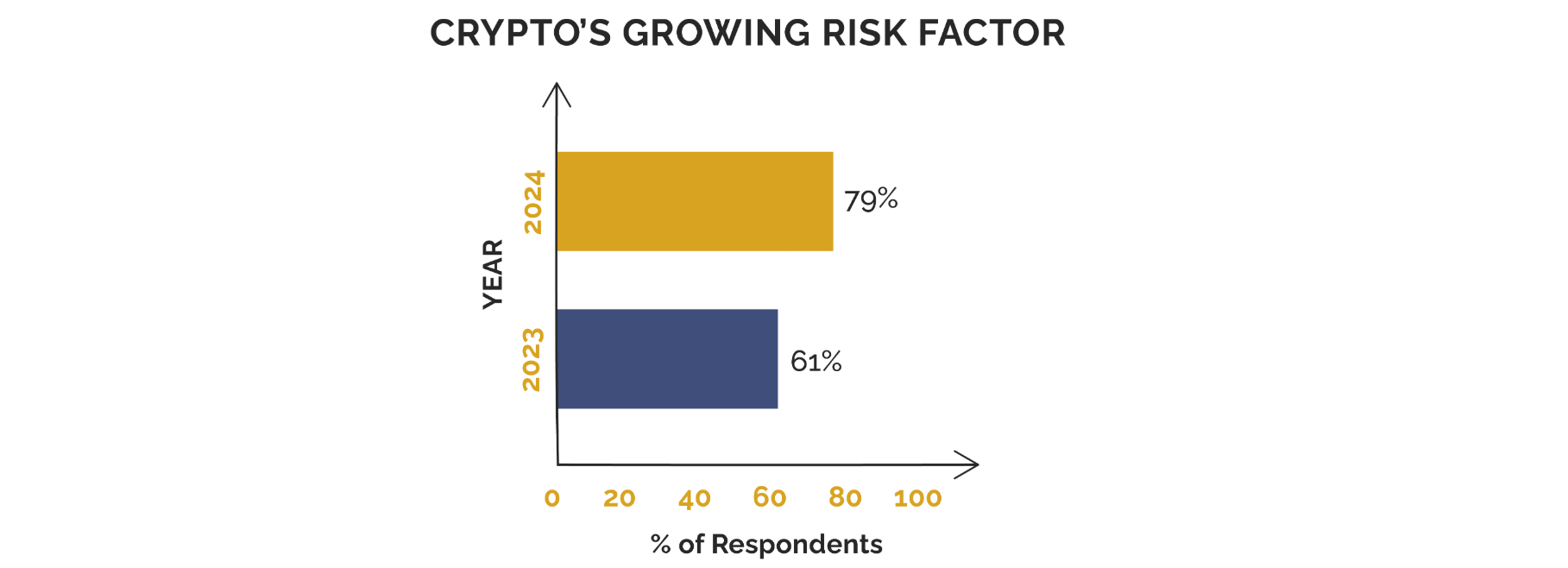

The perception of risk in the crypto space has shifted dramatically in 2024. According to recent data, 79% of respondents now consider crypto the riskiest sector, a significant jump from 61%. But what’s driving this surge in concern, and how is it reshaping the landscape for talent acquisition in this space?

In this sixth instalment of our Fintech blog series, we explore the underlying causes of this growing caution, its impact on hiring, and what companies can do to address these challenges.

Why is Crypto Perceived as Riskier in 2024?

Several factors have contributed to the rising perception of crypto as a high-risk industry:

Market Volatility: Unpredictable price swings have left investors and companies alike cautious about committing to the sector.

Regulatory Challenges: Governments worldwide are tightening regulations on crypto transactions, which introduces uncertainty for both businesses and professionals entering the field.

High-Profile Failures: The collapse of prominent crypto platforms and projects has amplified fears around security, governance, and long-term stability.

These challenges have combined to create a climate of unease, not only for investors but also for professionals considering careers in crypto-related fields.

The Impact on Talent Acquisition in Crypto

This perception shift is having a ripple effect on hiring within the crypto sector. With heightened risk comes hesitation, both from job seekers and employers. Professionals are increasingly evaluating the stability of potential employers, while businesses may struggle to position themselves as secure, attractive places to work.

Interestingly, distributed ledger technology (DLT) and blockchain principles remain strong draws for candidates intrigued by innovation. However, companies need to address the broader risk concerns to turn interest into commitment.

How Crypto Companies Can Mitigate Risk Perceptions

For crypto organisations, the key to overcoming these challenges lies in clear communication and proactive strategies:

Highlight Stability: Emphasise long-term viability, funding sources, and business continuity plans to reassure potential hires.

Promote Transparency: Be upfront about risk management practices, compliance efforts, and how the company navigates regulatory challenges.

Showcase Success Stories: Share case studies of how your organisation has weathered market volatility and delivered consistent results.

Invest in Employee Trust: Offer retention bonuses, clear career progression paths, and hybrid work flexibility, features increasingly valued across Fintech, as seen in earlier blogs in this series.

Broader Investor Caution and Crypto’s Future

This rising perception of risk is not isolated to crypto alone. In 2024, investor caution extends to other sectors, including information security, as inflated valuations have triggered widespread scrutiny. While these broader trends play a role, they also underline the importance of positioning crypto as a credible and resilient industry.

Conclusion: Turning Risk into Opportunity

While the perception of crypto as a risky industry continues to grow, it doesn’t have to be a barrier to attracting top talent. By prioritising transparency, stability, and employee value, crypto companies can position themselves as leaders within the Fintech space.

For professionals, the allure of innovation in DLT and blockchain remains strong, but companies must provide the assurance they seek. With the right strategies, the crypto sector can transform risk into opportunity, ensuring it continues to draw the talent needed to thrive.

Missed the earlier blogs in this series? You can find them on our website, where we’ve covered everything from workplace preferences to hiring trends and what truly matters to Fintech professionals today.

Stay tuned for more insights as we continue to explore the trends shaping the future of Fintech!