Last year, we invited senior professionals to participate in our annual survey on the candidate experience within the Fintech start-up and scale-up space. These insights helped us gather valuable data on hiring trends, which we compiled into a comprehensive whitepaper. The results provided a snapshot of how professionals evaluated potential employers in the Fintech space.

This year, we ran the survey again to track year-on-year changes. We're excited to share the first part of the results from our 2024 survey, Candidate Considerations When Joining a Fintech Start-Up/Scale-Up, bringing you the latest industry insights. Stay tuned as we roll out more findings in our blog series over the coming weeks.

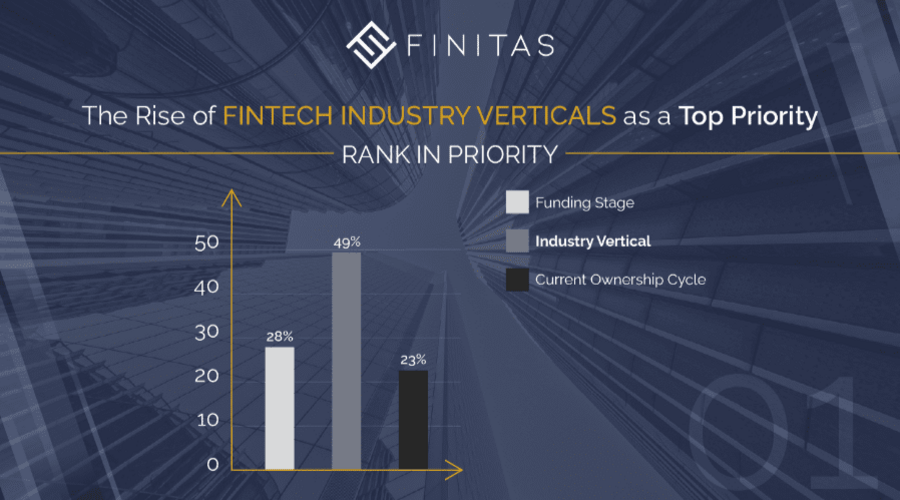

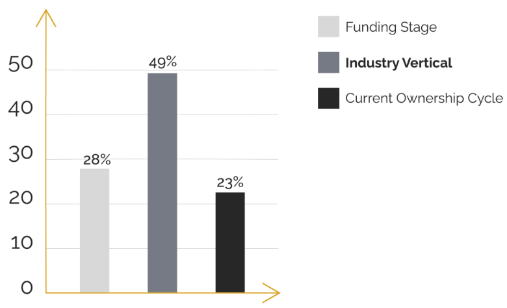

Why Industry Vertical Now Trumps Funding Stage in Career Decision-Making

Over the past year, we’ve seen a significant shift in how candidates evaluate career opportunities. According to our latest candidate survey, ‘industry vertical’ has overtaken ‘funding stage’ as the primary factor influencing career decisions, with 49% of respondents now prioritising it over other considerations. This marks a notable change from last year when ‘funding stage’ was the leading concern.

Why the shift? Candidates are increasingly focused on long-term growth potential and stability within specific industries. Whether it's the appeal of an established vertical or the chance to work on cutting-edge solutions in sectors like Fintech, professionals are aligning their career paths with industries that offer security and room for advancement.

From Funding Stage to Industry Vertical: A Major Shift

Last year, funding stage topped the list of priorities for candidates, driven by the appeal of high investment levels, fast growth, and the opportunity to be part of something exciting. However, this year’s survey shows that nearly half of respondents now favour industry vertical over funding stage. While funding remains important, candidates are placing greater value on being part of a stable, well-established sector that offers clearer long-term career prospects.

For many professionals, the resilience of an industry vertical, its ability to weather economic fluctuations, and the potential for steady career progression are becoming more attractive than the uncertainties tied to early-stage funding rounds.

Industry-Specific Growth and Stability

The rise of industry vertical as a priority reflects wider market trends. In sectors like Fintech, we see continued success in companies tackling major industry challenges. Despite a "funding winter" in some areas of Fintech, key verticals such as digital banking, payments, and cybersecurity continue to thrive. For instance, Nubank, with over 100 million users in 2023, is a prime example of how companies focused on strong industry verticals can succeed even in a funding slowdown.

Case Studies: Success Stories from Industry Vertical Leaders

Specific Fintech verticals, such as digital banking and payments, are seeing surges in talent interest. Nubank’s success in tapping into the underserved Latin American market showcases the long-term potential of focusing on a strong vertical. Monzo, another leader in the space, continues to attract talent and customers by providing user-friendly, innovative banking solutions.

Other industries are following similar trends. In the green technology space, companies addressing sustainability and global challenges like climate change or renewable energy are experiencing robust investment and increased candidate interest. Fintech sectors focused on financial crime prevention, cybersecurity, and payments are also gaining momentum. Regtech in particular is seeing massive growth, driven by the need for regulatory compliance solutions.

Conclusion: Fintechs and Industry-Specific Innovation

Our analysis highlights a key trend: Fintechs that focus on solving critical industry challenges, whether in financial crime prevention, Regtech, green technology, or payments, are increasingly capturing the attention of both candidates and investors. This shift not only underscores the growing importance of aligning with industry verticals that promise innovation, stability, and long-term growth, but also reflects a broader market evolution.

For professionals seeking career advancement and companies looking to attract top talent, aligning with strong industry verticals is now more essential than ever. As we continue to explore these emerging trends, it’s clear that Fintechs prioritising industry-specific solutions will play a pivotal role in reshaping the future of recruitment.

Stay tuned for the next post in our series, where we’ll delve further into these industry-specific trends.