In today’s workplace, flexibility is no longer a perk, it’s a priority.

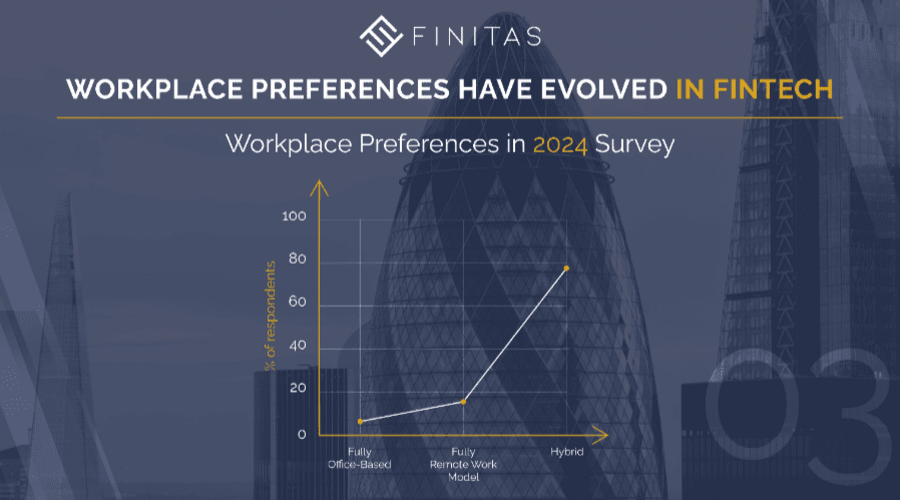

Our 2024 candidate survey reveals a significant shift in workplace preferences: while fully remote setups have plateaued, the demand for hybrid work has surged. A mere 7% of respondents now favour a fully office-based role, underscoring the appeal of hybrid models as the future of work in Fintech and beyond. This growing preference shows that employees are no longer just looking for convenience; they’re seeking an arrangement that balances flexibility with collaboration.

In this third instalment of our blog series, we’ll explore why hybrid work is thriving in the Fintech space and how companies can make the most of this model.

Hybrid Work Takes Centre Stage in Fintech

Hybrid work has become the preferred model for employees, especially in the fast-paced Fintech industry. While about 15% of our survey respondents prefer fully remote work, the majority are drawn to hybrid setups, which offer both flexibility and the benefits of in-person collaboration. For Fintech firms, particularly start-ups and scale-ups navigating tight funding conditions, hybrid models provide a strategic advantage by combining cost savings with a broad talent pool.

In central locations like London, where many Fintechs are based, employers are pushing for at least three days a week in the office. However, this approach may inadvertently drive turnover as candidates who relocated outside of urban centres seek roles that accommodate their flexible lifestyles. As hybrid work gains traction, it’s clear that Fintech companies must prioritise a balanced approach to retain their workforce and attract top talent.

Hybrid Models: The Best of Both Worlds

Hybrid work models cater to a broad spectrum of employee needs, offering the flexibility to work from home while retaining access to the collaborative benefits of office spaces. In Fintech, where innovation and quick iteration are crucial, this blend of flexibility and in-person interaction has been transformative. Companies can scale back physical office space, reducing overhead costs, while employees enjoy the autonomy to work from locations that best suit their needs.

Moreover, hybrid models can act as a talent magnet. Start-ups facing tight capital constraints find that offering a hybrid model attracts skilled professionals who value work-life balance. With capital still difficult to secure in many areas of Fintech, reducing operational expenses via a hybrid setup has allowed companies to allocate resources to growth and innovation rather than office space.

A Strategic Advantage for Fintech Start-Ups

In the Fintech sector, which remains highly competitive and often constrained by funding challenges, hybrid work has proven to be a strategic asset. Early-stage companies, in particular, benefit from hybrid models as they provide flexibility while controlling costs, an appealing proposition to investors looking for sustainable growth. Additionally, new advancements in technology, such as generative AI (GenAI), are making remote collaboration easier. GenAI supports productivity enhancements across departments, from coding to customer support, allowing employees to work efficiently from home while still engaging in collaborative projects.

By embracing a hybrid work culture, Fintech firms demonstrate a commitment to innovation, flexibility, and employee well-being. This approach also appeals to a younger, tech-savvy workforce that values flexible work arrangements as much as competitive compensation.

Embracing Hybrid Work for Long-Term Success

As hybrid work solidifies its place in the modern workplace, Fintech companies must adapt their policies to support it effectively. To create a successful hybrid work environment, Fintech firms can focus on the following strategies.

Flexible Scheduling Policies: Empower employees to choose in-office days that align with team goals and personal needs, ensuring that collaboration and individual productivity are maximised.

Investing in Technology: Equip teams with collaboration tools, such as project management software and video conferencing platforms, to make hybrid work seamless. Technologies like GenAI can further enhance productivity by streamlining tasks, enabling employees to be effective from anywhere.

Redefining Office Spaces: Design office spaces that prioritise collaborative areas over individual workstations, creating an environment that employees want to visit and that facilitates teamwork.

Frequent Communication and Support: Maintain open lines of communication with teams to understand evolving preferences, address any challenges, and reinforce a positive hybrid work culture.

As Fintech continues to grow and adapt, hybrid work models offer a path forward that aligns with employee preferences and strategic business goals. By balancing in-person collaboration with remote flexibility, Fintech firms can create a resilient and attractive workplace that supports both innovation and talent retention. As our survey shows, hybrid is here to stay, and companies that fully embrace it will be well-positioned to attract and retain top talent in the years to come.

Stay tuned for our next instalment, where we’ll delve further into the latest trends in Fintech recruitment and how companies can adapt to an ever-changing workforce.

Alternatively, you can catch up on Part 1 and Part 2 here.