As part of our Fintech blog series exploring the evolving priorities of professionals in this dynamic sector, we’ve uncovered a surprising shift in what matters most to employees.

In earlier posts, we’ve discussed the decline of traditional bonuses, the rise of hybrid working, and the patience of Fintech job seekers when it comes to finding the right fit. In this fifth instalment, we’re diving into the growing importance of leadership and the direct manager's role in employee satisfaction, an area that’s now outpacing work-life balance as a deciding factor for many.

Leadership Over Work-Life Balance

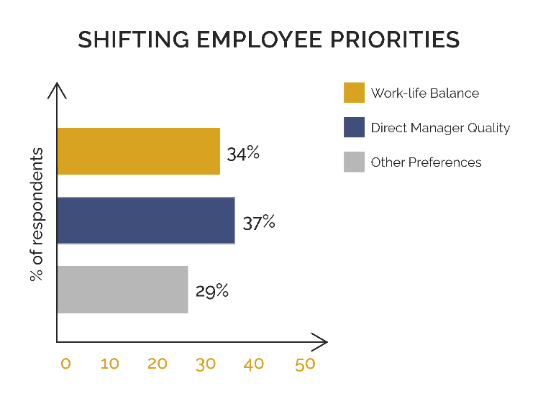

Work-life balance has long been a buzzword in employment conversations. However, our recent data, derived from our candidate survey, shows that only 34% of employees now prioritise it, compared to 37% who value the quality of their direct manager. This isn’t just about leadership taking the spotlight, it’s about how workplace relationships, particularly the one with a direct boss, have become critical to overall job satisfaction.

This shift doesn’t suggest that work-life balance no longer matters, but rather that employees are focusing on leadership qualities that directly impact their day-to-day experience. After all, no amount of flexibility can make up for poor management.

The Growing Importance of Leadership in Fintech

In Fintech, where innovation and adaptability are key, strong leadership can be the difference between thriving during financial challenges and losing top talent. A direct manager’s ability to create trust, provide guidance, and adapt to changing demands is more important than ever. Employees are increasingly valuing managers who:

Communicate clearly and empathetically.

Prioritise professional development.

Lead by example in high-pressure environments.

With Fintech professionals facing unique challenges, from navigating fast-paced environments to managing industry instability, the quality of leadership can significantly influence career choices.

Why Employees Leave: It’s Often About the Boss

Studies repeatedly show that the number one reason employees resign isn’t salary or benefits, it’s their boss. A direct manager can make or break the employee experience, which is why the perception of work-life balance has shifted. The spotlight is now on whether companies are equipping managers with the tools they need to succeed.

For Fintechs, this raises critical questions:

Are managers given proper training and development opportunities, or are they expected to "figure it out" on the job?

Is there a structured approach to leadership development, or is it left to chance?

Building Stronger Workplace Cultures Through Leadership

To remain competitive, Fintech companies must invest in leadership development programmes that help managers refine their skills and create meaningful connections with their teams. Initiatives like mentoring, coaching, and targeted learning and development (L&D) can transform workplace cultures and strengthen retention.

Additionally, establishing open communication between employees and managers can lead to a more collaborative environment, ensuring that leadership quality remains a core pillar of workplace happiness.

Conclusion

In the Fintech world, where innovation drives success, strong leadership is no longer a luxury, it’s a necessity. The shift in employee priorities highlights the critical role of direct managers in shaping workplace satisfaction and retention. By investing in leadership development and prioritising the employee-manager relationship, Fintechs can create cultures where both people and businesses thrive.

If you missed the earlier posts in our Fintech series, check them out here:

The Fall of the Bonus in Fintech: What Really Matters in Compensation Today

Workplace Preferences Have Evolved in Fintech: Why Hybrid Is Here to Stay

Stay tuned for more insights as we continue to explore the evolving landscape of Fintech talent!